How An Internet Group Revolutionized The Stock Market

Over the past month, the internet has been taken by storm: cries of “Can’t Stop! Won’t Stop! GameStop!” and “$GME go BRRR” echo around the deepest corners of the web. A Reddit community, r/wallstreetbets, has not only revolutionized short-stock trading and shaken Wall Street to its core, but has also brought attention to the power of the internet and how strong regular people can be if they work together. The community banded together to make millions of dollars off of a synchronized assault against Wall Street.

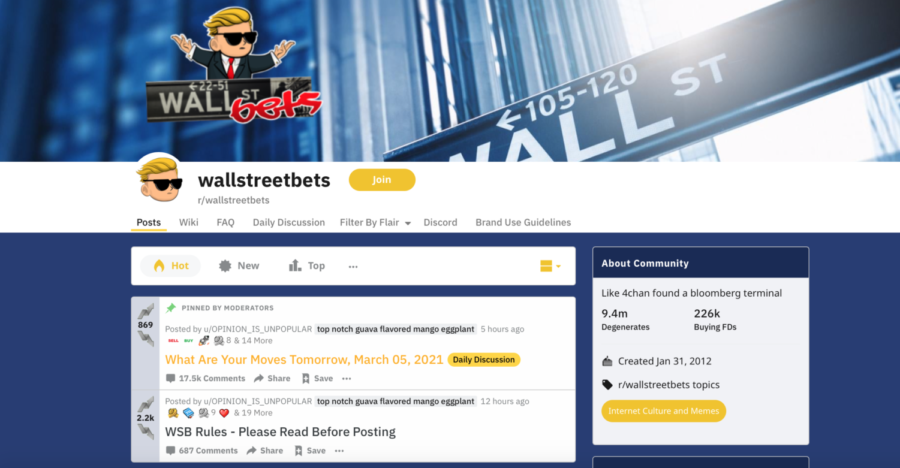

For background, r/wallstreetbets is a Reddit community in which stock owners can discuss potential gains, stocks that are good to buy, and more. Reddit is a social media platform with thousands of communities that are moderated by users, ranging from the cute (r/aww, with pictures of adorable dogs and cats), to the funny (r/memes, r/dankmemes, r/funny, to name a few), and to the advice centered (r/legaladvice, r/relationships, r/aita). All of these serve to unite those with similar interests. The Redditors of r/wallstreetbets, however, have used this unity to create a “revolution” of sorts, changing the stock market and its approaches forever.

Additionally, a knowledge of stocks is needed to understand what exactly happened in this community. Essentially, the subreddit uses a tactic called “short selling” to make huge profits. According to the U.S. Securities and Exchange Commission, “A short sale occurs when you sell stock you do not own. Investors who sell short believe the price of the stock will fall. If the price drops, you can buy the stock at the lower price and make a profit.” The r/wallstreetbets community targeted specific stocks that were failing so they could get them for less, and then used the rush of Redditors who were buying to make a profit. The more people that buy a stock, the more valued it is, and the more its worth goes up in the market. This is because it becomes harder to get, which is why the system of supply and demand works here. Currently, there are 8.9 million people in the subreddit, which shows the impact that a synchronized attack can have. For example, the most well-known stock that they targeted was GameStop. GameStop (GME) has been struggling for a while now, and the Redditors took advantage of the low stock prices to skyrocket their profit. They also bought and held stocks in AMC, M (Macy’s), and BB (Blackberry). A CNN article states that “GameStop is up more than 1,700% since the start of January. Some trading platforms, including TD Ameritrade and Robinhood, are restricting trades on AMC and GameStop.”

The effect that the sudden gains have had on Redditors who invested is astronomical. One Redditor, u/DeepF*****gValue, made approximately $46 million off of these stocks in January 2021 alone. u/Longjumping_Ad_5881 posted in January that they had been able to pay off their student loans, with a total of over $24,000 gained. Another user, u/kindag*yinmyfreetime, gained over $1.5 million in the past month, from an initial investment of only $20,000 in GME stocks. Other Redditors donated some of their money to benefit children in hospitals. u/Lunar033 donated 6 Nintendo Switches to children in the Children’s Minnesota Hospital. The benefits, for many, have been great, but Wall Street hedge funds are reeling.

Many hedge funds have been negatively affected by the sudden boom of short selling. It’s estimated by Business Insider that hedge funds on Wall Street have lost a collective $19 million because of the boom in GameStop stock. The impact that r/wallstreetbets has had on the stock market isn’t just financial. There has been controversy over the way trading apps, such as Robinhood, have handled the situation. Robinhood, among others, hid the stock options for AMC, GME, and other popular stocks from view, which was viewed as oppression by many Redditors. Additionally, many took offense to the difference between the treatment of hedge funds and the subreddit’s users. One user, u/game_stone, posted a screenshot of a tweet that read, “Remember when senators got coronavirus briefings before the public and sold off millions of dollars in stocks before the crash last year and faced no consequences and no regulation? Then Reddit made one stock into a meme and they’re talking about restructuring the whole market.” The incident that u/game_stone is referring to is when four senators, including Rep. Kelly Loeffler, sold hundreds of thousands of dollars worth of stocks around a month before the stock market crashed. Loeffler in particular sold $1.2 million dollars’ worth of shares before the crash, which saved her from huge losses. The senators faced no punishment. There were also concerns that they had violated the STOCK Act, which prohibits “members of Congress from making financial trades based on nonpublic information.” The key difference between r/wallstreetbets and the senators is that all of the information being shared on that subreddit is available to the public, even those without a Reddit account.

Overall, the effects of the coordinated short selling by this subreddit is having repercussions in essentially every way. Although the approach may be unconventional, it is working, at least for now, and the Redditors have no intention of stopping, as their current slogan is “$GME to the moon!”